Aegis was a sponsor at this year’s NGC/IAMovement ‘Green Infrastructure in the Caribbean’ conference which took place last month at Hilton Trinidad on 25 October. As a business owner, you may be wondering how climate finance can affect your company. After all, climate finance is a relatively new concept and one that is still evolving.

The 2-day hybrid event focused on green infrastructure particularly the Vetiver System and connected guests with leading Caribbean and Latin American stakeholders relating to innovative finance. The event also included an in-person green expo and site visits where green infrastructures were already in place and showing progressive development in Trinidad and Tobago.

We met with our accounting and audit leaders Vernetta Guischard, Leigh-Anne Pierre and business development lead, Jenna-Marie Pollard to learn a few key takeaways from the conference for your business and what you need to know about Climate Finance.

Here’s what you need to know.

What is Innovation Finance?

Innovative finance is a term used to describe new ways of raising money and investing in projects. It includes a wide range of activities, from crowdfunding and peer-to-peer lending to impact investing and venture capital. Innovative finance is often used to fund social or environmental projects that may not be able to attract traditional investment.

This is because investors are motivated by more than just financial returns – they also want to make a positive impact on the world. Innovative finance is a growing industry, and there are a number of different products and services available including climate finance. If you’re looking for funding for a project or business, it’s worth exploring the options to see what’s right for you.

What is climate finance and why does it matter?

Climate finance is the funding provided by governments and other entities to support projects and programs that aim to mitigate or adapt to climate change. The world’s climate finance needs are huge and growing. It is important because it can help countries reduce their emissions of greenhouse gases, which are the main cause of climate change, and adapt to the impacts of climate change, such as rising sea levels and more extreme weather events. In order for the world to meet the goals of the Paris Agreement on climate change, it is estimated that USD$100 billion per year will need to be provided for climate finance. This money can help countries switch to renewable energy, improve their resilience to climate impacts, and take other measures to reduce their emissions and adapt to climate change.

According to the International Energy Agency (IEA), climate finance needs to reach USD$5 trillion per year by 2030 in order to meet the world’s climate goals. This is an increase of more than USD$2 trillion per year from today’s levels.

The IEA’s estimate includes both public and private finance, and it is broken down into USD$3.5 trillion for mitigation (i.e. emissions reductions) and $1.5 trillion for adaptation (i.e. measures to help societies deal with the impacts of climate change).

The USD$5 trillion figure is just an estimate – the actual amount of finance required will depend on a number of factors, including the pace of technological change and the stringency of climate goals. But it is clear that the world’s climate finance needs are vast, and will require a significant mobilization of resources. A number of initiatives are already underway to increase climate finance.

What are the financial solutions and mechanisms that create scalable and effective ways of

channeling both private money from the global financial markets and public resources to

mitigate these challenges?

Climate Finance is relatively a new concept in the Caribbean. Businesses such as the National Gas Company and Republic Bank have started to lead the way in getting businesses prepared for the implementation of the Caribbean’s sustainable goals and objectives.

For example, Republic Bank Ltd.’s Journal of leadership and climate-change states, “the Climate Finance Goal, sets us on a path to lend, invest and arrange US $200 million toward activities that reduce the impacts of climate change and create environmental solutions in collaboration with our clients by 2025. Working with various communities, we set our sights on increasing the proportion of (a) electric and hybrid car loans, (b) loans linked to the promotion of clean fuels, renewable energy use and technology, (c) loans contributing to an improvement in energy efficiency and (e) new construction loans that deploy climate resilient technology. The proposed US $200 million commitment aligns with Republic Bank’s optimal risk appetite by directing capital towards the environment, renewable energy, green initiatives, blue economy and socially focused projects.”

How does the Caribbean mobilize climate finance?

One of the most important aspects of the Caribbean environment is its green infrastructure. This includes the region’s forests, wetlands, and coral reefs, which are all vital to the health of the ecosystem. The forests of the Caribbean provide a home for many species of animals and plants, as well as a vital source of oxygen and fresh water. They also help to regulate the climate, providing shade and cooling the air during the hot summer months. The wetlands of the Caribbean are important breeding grounds for many fish and amphibian species. They also play a vital role in filtering pollutants and providing a buffer against storms and floods. They are also important for tourism and the local economy, as they attract scuba divers and snorkelers from all over the world.

The green infrastructure of the Caribbean is essential to the health of the ecosystem and the people who live there. It is important to protect and conserve these vital resources for future generations.

How would green infrastructure affect your business?

If your business is located in an area that is prone to flooding, green infrastructure can help to reduce the risk of flooding. Alternatively, if your business is located in an area that is prone to drought.

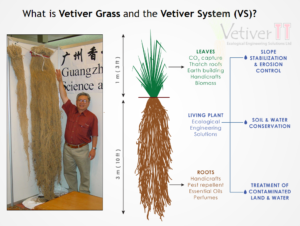

IAMovement demonstrated how green infrastructure such as the vetiver system can help to reduce the risk of drought or flooding in disaster-prone areas.

The Vetiver (Chrysopogon zizanioides) is a perennial grass that is native to India. It is also found in Sri Lanka, Nepal, Indonesia, and Malaysia. The Vetiver plant can grow up to 1.5 meters (5 feet) tall and has long, thin leaves. The roots of the Vetiver plant are very strong and can grow up to 2.5 meters (8 feet) long. The vetiver plant is extremely efficient in implanting such green infrastructures as it absorbs carbon dioxide and converts it into oxygen. One study found that a hectare of vetiver can sequester up to 10 tonnes of carbon dioxide per year. This makes the vetiver plant an important tool in the fight against climate change. In addition to sequestering carbon dioxide, the vetiver plant also helps to combat soil erosion. According to IAMovement, the deep roots of the vetiver plant help to stabilize the soil and prevent erosion. This is important in areas that are prone to flooding or where there is a risk of landslides. The vetiver plant is also drought-resistant and can help to improve water quality. The plant helps to purify water by trapping heavy metals and other pollutants. This makes vetiver an important plant for both combating climate change and improving water quality.

Here’s a brief overview of how climate finance can impact your business:

You may be eligible for climate finance.

If your business is located in a developing country. This can help you offset the costs of adapting to climate change or investing in green technologies.

Your business may be affected by climate finance projects.

If you do business in a developing country, you may be impacted by climate finance projects. For example, a project to build a dam in a developing country could impact your business if it alters the local water supply.

You may be able to invest in climate finance.

If you have extra cash on hand, you may be able to invest in climate finance. This can help you support projects that are aimed at mitigating climate change, and you may even be able to earn a return on your investment.

The benefits of climate finance to businesses can be broken down into four main areas:

- Mitigation: Climate finance can help businesses reduce their emissions, which is a key part of mitigating climate change. For example, a company that uses renewable energy can benefit from subsidies and other financial support to help reduce its costs.

- Adaptation: Climate finance can help businesses and governments adapt to the effects of climate change. For example, a company that is located in a coastal area may need to adapt to rising sea levels.

- Businesses: Climate finance can help businesses reduce their costs, which can lead to increased competitiveness. For example, a company that is able to reduce its energy costs can gain an edge over its competitors.

- Society: Climate finance can help society meet its goals of mitigating climate change and adapting to its effects. For example, climate finance can help build infrastructure that is resistant to climate change, such as seawalls.

There are a few challenges to climate finance for businesses. The first is that it can be expensive to access. It can also be difficult to predict how much money a business will need, and it can take a long time to receive funding. Additionally, climate finance can be difficult to track and manage, which can be a challenge for businesses when trying to budget for future projects.

It’s important to stay informed about how climate finance might affect your company, and to make sure you are eligible for any benefits that may be available.

Learn more about the work of IAMovement here https://iamovement.org/cgic2022/

Aegis Business Solutions are the auditors of IAMovement. Learn more about us here https://www.aegistt.com/services/aegis-co/