Our Aegis culture is very important to us. We recognize success requires working as a team and across teams in a fun, caring and respectful environment. Each person is accountable yet all empowered and enjoys an extraordinary degree of independence because freedom stimulates initiative.

Current Vacancies

Caribbean Fraud Conference: Fraud, Compliance & Security: The Fraud Tiers

On June 8 and 9, 2015, I attended the first annual Caribbean Fraud Conference, entitled, Fraud, Compliance & Security: The Fraud Tiers, which was hosted byTrinidad and Tobago Coalition of Services Industries (TTCSI) and Global Forensic Institute (GFI). In his...

5 Reasons to Outsource Your Payroll Services

Ensuring that your employees are on paid on time is a key part of the efficient running of a business--it sets standards to be adhered to and sends the message that your employees and their needs are well taken care of, in turn fostering greater employee satisfaction....

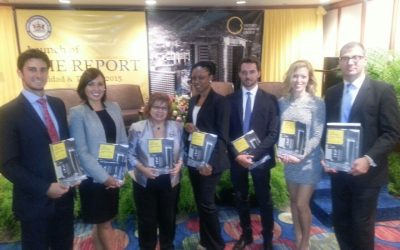

OBG & Aegis collaborate on economic report

We are pleased to announce Aegis Business Solutions Ltd has signed a memorandum of understanding (MOU) on research with UK’s leading global publication Oxford Business Group (OBG) for its first-time report on T&T’s economy.

Expanding your business into the Trinidad and Tobago market: What you need to know

Trinidad and Tobago is at an exciting time in its development and is well poised to be the location of choice for foreign direct investment. Consistent with the global trend, we are witnessing in Trinidad and Tobago businesses large and small directing their energy and resources toward core activities, in pursuit of their unique competitive advantage.

Proposed Amnesty – Trinidad and Tobago 2016

The Finance (No. 2) Bill 2016, proposes a tax amnesty for taxes and other liabilities that were due and payable up to December 2015. The amnesty would include the waiver of interest, penalties and other liabilities on late filings and late payments on: income tax, corporation tax, withholding tax, business levy, petroleum tax and value added tax.

Audit matters: Why audit? Insights for small businesses

Capital and a steady revenue stream are two of the cornerstones of any up and coming or long standing organization. Small organizations in particular need to equip themselves with the resources and skill sets to compete in the evolving markets. A large part of this involves capital and opportunities.Capital and a steady revenue stream are two of the cornerstones of any up and coming or long standing organization. Small organizations in particular need to equip themselves with the resources and skill sets to compete in the evolving markets. A large part of this involves capital and opportunities.

Carnival Information Update – Tax

Have you sponsored a local production or carnival activity?

Here is a tax reminder if your business was involved in any carnival related activities or sponsorship of any local entertainment activities.

Building Your Star Team Locally

Trinidad and Tobago continues to strengthen its reputation as the nearshore destination for offering services to the wider Caribbean and gateway to Central American market.

Foreign companies considering setting up in the Caribbean must spend time investigating their options